Payroll Outsourcing in France

Mon Embauche Facile helps international companies outsource payroll in France with a simple, fast, and fully compliant solution.

We take care of everything including payslips, DSN submissions, employee entries and exits so you can focus on growing your business.

Based in France, our team ensures full URSSAF and DSN compliance from day one.

Payroll Services in France for Foreign Employers

Are you hiring employees in France?

Our English-speaking payroll experts provide a complete payroll service for foreign employers even if you don’t have a legal entity in France.

We handle your French payroll processing, social contributions, employment contracts, and URSSAF compliance, ensuring your company stays fully compliant with local legislation.

Our clients are:

- International companies expanding into France

- Foreign employers without a French entity (ESEF status)

- Start-ups hiring their first French employee

- SMEs and accountants seeking reliable local payroll support

We provide a turn-key payroll outsourcing solution designed to make your French operations simple and compliant from day one:

- Payslip creation (Silae software) – Each payslip is fully adapted to your collective agreement and verified for accuracy.

- DSN declarations – Monthly social and tax reporting to French authorities.

- Employee onboarding & offboarding – Entries, exits, and final settlements handled for you.

- Employment contracts & amendments – Drafted according to French labor law.

- Communication with URSSAF & tax authorities – We handle all interactions for you.

- Full HR & labor law assistance – Unlimited support in English.

- Payroll processed within 24 hours – Fast and reliable service.

✅ 100 % compliant with French payroll legislation

✅ Secure SaaS platform for file exchange

✅ English-speaking support team based in France

A single package for processing your payroll

Transparency and savings nationwideAt Mon Embauche Facile, transparency is our priority. Unlike other payroll providers, we guarantee zero hidden fees. Whether it’s onboarding a new employee or handling a departure, everything is included.

- ✔️ No setup fees

- ✔️ No commitment offer

- ✔️ Payroll processed within 24 hours or less

- ✔️ Unlimited support for labor law and HR matters

- ✔️ Monthly DSN included

consultation

How It Works — Go Live in 4 Simple Steps

Outsource your French payroll with our simple four-step process. Save time, ensure full compliance with French labor laws, and experience a seamless onboarding from day one.

Why Choose Our French Payroll Firm

English-speaking payroll experts

You’ll have a dedicated contact who speaks English and understands international company structures. No language barriers, just clear communication.

Expertise in French payroll

Our team is based in France and trained on Silae, the country’s most trusted payroll software. We stay up to date with all legislative changes to ensure your payrolls are always accurate and compliant.

Compliance & reliability

We manage all mandatory reports and contributions (URSSAF, social security, DSN). You stay compliant, effortlessly.

Cost-effective

At only €20 per employee, our service is one of the most affordable on the French market, while maintaining high-level accuracy and compliance.

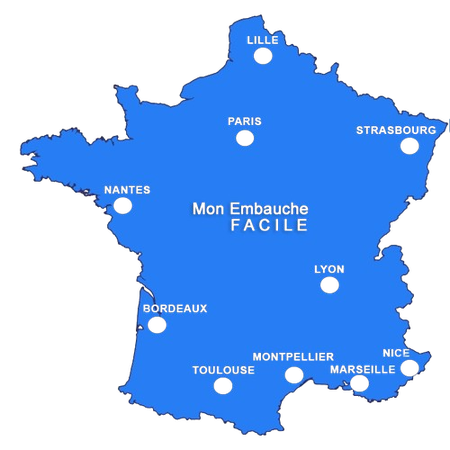

Nationwide Coverage in France

Our service is 100 % digital, but our payroll experts are based in Paris, Lyon, Toulouse, and Marseille.

Wherever your employees are located, we can manage their payroll in compliance with French regulations.

Payroll Outsourcing – Frequently Asked Questions

Q: Can I outsource payroll in France without a French company?

Yes. We can process payroll for foreign employers under the ESEF status, allowing you to pay staff in France legally.

Q: How fast can you start?

Within 48 hours. We just need your company and employee data.

Q: Do you handle DSN and URSSAF declarations?

Absolutely — all mandatory submissions are included.

Q: Do you offer HR assistance in English?

Yes. Our team provides unlimited English-speaking support in payroll, HR, and French labor law.